Boost Your Purchase Power By Using Your Current Pay Stub

When pre-approving people for home loans they are often frustrated by the strict income underwriting guidelines. This is because an individual’s monthly income may include income that is classified as “non-qualifying” income which means it can’t be used without a 2-year history. These types pay include overtime, commission, bonus, sick, or incentive pay among many others. Now you can boost your purchase power by using your current pay stub and all of those “special” categories of income.

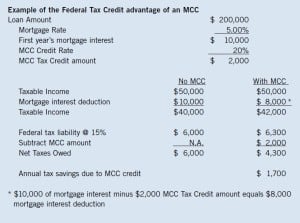

How do we do this? Through the CalHFA Mortgage Credit Certificate (MCC for short). This is a federal income tax credit which reduces the borrowers’ potential federal income tax liability. This credit, in effect creates additional net spendable income which borrowers may use toward their monthly mortgage payment. See the table below for an example of this tax credit.

Based on the example in the table above the annual tax savings is $1,700 which translates to $141/mo in extra qualifying income. Based upon a current-market PITI $141/mo translates to $28,000 more in purchase price.

858-863-0264