When is the best time to plant a tree? 10 years ago, right? When is the next best time? Now!

It’s been said that luck is always preparation meeting opportunity. I would only add, in this context anyway, that it happens at the intersection of prudence. We need to look no further than the last 7 years to determine why that last part is abundantly important. It’s no longer ‘cute’ to look at real estate as an investment that’s addicted to “hope-ium.” To be a buyer in this brand new marketplace you’ve got to be willing to do what other people don’t to get what most people won’t.

We are the (un)official home of the first-time homebuyer here in San Diego. It’s 92% of our buyer business and we are consistently top 1% in production, county-wide .. so we have more first-time homebuyers come through these green doors than any other shop in town. We are VERY proud of that. It’s our niche.

Whether that’s you moving-up from your first-home to accomodate a family on the grow, or, a vacation home for a serial vacationer = we got your back. There are strategic benefits cooked into a second home purchase & you’ll want to combine your desired lifestyle w/ a mortgage plan to take full advantage of both!

A sound investment property has you making money twice: becuase now you’re reaping the benefits of renting the doors vs. just holding them. Now your wealth can compound and begin to accelerate as the blended gains of appreciation combine with cash-flow to create escape velocity from the grind.

Preparation | The Best Home Search Tool, EVER.

Here’s our step-by-step, formulaic approach, to making sure you arrive at exactly where you are supposed to be, on time & safely (aka a quick primer on how we separate ourselves from everyone else out there)

Step 1: “Huddle Up” | 90 Minute Initial Consultation

Ideal Time Frame: 3 – 1 months away from target buy date

That video above is from 2008! We’ve been taking this “different” approach to Real Estate Consulting from day 1. And if you’re wondering what its all about and why its important to you, you might be curious to know what some other people from even way back then were saying about it.

The Anatomy of the 90 Minutes:

Initial 10 minutes:

“Opening Ceremonies.” Its “hello” on steroids. Then we get to work.

The first 30 minutes is all about you:

- What are you after?

- Where are you looking?

Then, 20 minutes invested in the How:

What are the 2 biggest challenges awaiting you in this market?

-

- What’s my 3 part plan to navigate you through those challenges?

- Introduction to our 6-Step Process.

- Reveal my 3 critical roles.

Most importantly, we end with 20 minutes to discover your Why:

-

- The 7 most important questions you might ever be asked

Final 10 minutes:

-

- I’ll offer my best advice to you, whether we believe we are a good fit & we get started on the plan.

Step 2: Identify Your “Purchasing Power” | Pre-Approval

Ideal Time Frame: 3 months – 1 month preceding target buy date

Mortgage Planner & a Mortgage Plan vs. Loan Officer & a Pre-Qual What is a Mortgage Planner?

|

Loan Officer Prequal |

VS |

Mortgage Planner Strategy |

| Gives you a $ amount you qualify for | Identifies the Best Structure for your unique situation | |

| Picks a program for you | Helps Compare ALL available programs so YOU can choose whch is best | |

| Decisions are based on numbers alone | Considers all aspects of your life to build a strategy |

Step 3: “The Big Bad Kickoff Tour” | SmartHome Tours

Ideal Time Frame: 3 – 1 months preceding target buy date

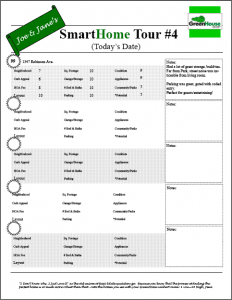

Here’s where most of my competition thinks I’m crazy, and most of my clients are thanking me crazy. Why, because now its time to have some fun and match the tongue in our mouth with the one in our shoe. We’ve sifted and sorted with MarketWatch, and its time to get in the car and play scientist with the available favorites on your list.  But (and here’s the crazy part): The goal of Step 3 is not to buy a home this day. While this drives traditional real estate agents nuts, our clients love it because they can understand that to be a successful buyer, the goal is to truly understand what makes up a cross section of your marketplace. When we get out there, experience shows that the last thing you want is to see 5 homes in an afternoon and leave only remembering the 1 living room that you loved the most. This will happen every time though because home buying is a very emotional process. It’s imperative that you have a checks-and-balances system to ensure that your left brain is getting as much of the attention as the right gets by default. Well, feel comfortable because we’ve thought of that for you, too. It’s called our GreenHouse SmartHome Liechert Scale and with it around you can kiss buyers remorse goodbye.

But (and here’s the crazy part): The goal of Step 3 is not to buy a home this day. While this drives traditional real estate agents nuts, our clients love it because they can understand that to be a successful buyer, the goal is to truly understand what makes up a cross section of your marketplace. When we get out there, experience shows that the last thing you want is to see 5 homes in an afternoon and leave only remembering the 1 living room that you loved the most. This will happen every time though because home buying is a very emotional process. It’s imperative that you have a checks-and-balances system to ensure that your left brain is getting as much of the attention as the right gets by default. Well, feel comfortable because we’ve thought of that for you, too. It’s called our GreenHouse SmartHome Liechert Scale and with it around you can kiss buyers remorse goodbye.

Step 4: “GO TIME!” | Where The Magic Happens

Ideal Time Frame: 3 months – 1 month preceding target buy date

Remember when we talked earlier about Gary Keller saying this market is “a price war and a beauty contest”, then me adding that its also a foot race? Well, here comes your chance to showcase your weapons, your good looks and your blinding speed. Now, with the Big Bad Kickoff Tour in your belt, you are officially the most seasoned new buyer in your marketplace right now, and you’re ready to rock because you have the one thing that’s missing from most of your competition: confidence. Confidence as to why you are here, what you are after, and the experiential base of having seen at least 5 homes already while studying what makes them good, bad & ugly. Now it’s time for the magic to happen. *Just in case you happen to be a in the market for a condominium or townhome, this little nugget from 2011 still applies today, and may find you well:

Whats the alchemy of happy new homeowners?

Monitor the best the market has to offer with your customized HomeFinder System: MarketWatch.

When you see something that you like, we get out there to see it ASAP

When you like it, we make prisoners of those thoughts on paper, make a commitment to buy and put your best foot forward

Then emotionally, physically, spiritually disengage from the outcome and let the rest take care of itself. In this market you optimize the variables that are in your control and you leave the rest to the powers that be.

Step 5: “Escrow” | 6 Victories To Get Your Keys

Ideal Time Frame: 1 month preceding target buy date

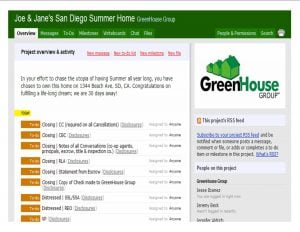

A real estate transaction in this brand new marketplace has a lot of what you might call “Integrated Complexity”. There are 100 pieces of paper requiring upward to 43 different signatures and initials, 100-150 different phone calls and emails, sometimes 43 different people from at least 14 different industries that all take place throughout the 7 stages of your loan process! Every “I” has got to be dotted, every “T” crossed – because if there are ever any mistakes made along the way, guess who pays for it? YOU (the buyers)! We use a premium platform service to ensure mistakes are mitigated, and a team assembled to carry that promise out. Kevin P., a recent client of ours, really appreciated the utility of this and mentioned it on his Yelp.com review: “He’s quick to put his one-on-one thoughtfulness to each and every step of the process and even creates a website that you can track each documented step of the lengthy process.” Thanks Kevin, and we hope you’ll come to appreciate that touch also.

Whats the alchemy of happy new homeowners?

Monitor the best the market has to offer with your customized HomeFinder System: MarketWatch.

When you see something that you like, we get out there to see it ASAP

When you like it, we make prisoners of those thoughts on paper, make a commitment to buy and put your best foot forward

Then emotionally, physically, spiritually disengage from the outcome and let the rest take care of itself. In this market you optimize the variables that are in your control and you leave the rest to the powers that be.

Step 6: “Celebrate!” | Key Party & Welcome To The Family

Ideal Time Frame: Target buy date achieved

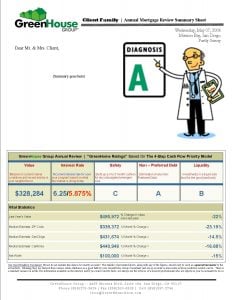

Once the dust of the HouseWarming party settles is where some of our clients tell us our greatest value begins. Where some people, like taxi-drivers, take off after they get their commission check only to never hear from them again. We like to keep a pulse of the market, our position within it and our long term goals in sight so we can remain intentional with our most valuable assets.