Stated Income Loans are Officially Back

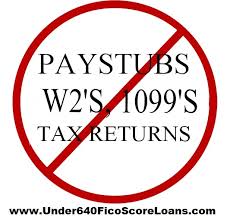

Well if anyone needed a sign that mortgage lending parameters have loosened, they now have it. Folks, stated income loans are officially back! These loans are still limited in who offers them and under what terms. However that seems to be changing weekly at this point. Currently the loans are mostly designed self employed borrowers or business owners.

Now these loans have proven to be a bit scary in the past. Mostly the trouble comes from the use of stated income loans as a means to qualify for more than you can afford. Of course buying a home you can’t afford rarely works out. If used properly these homes can help self employed folks qualify even when their income docs don’t support the requirements traditionally sought after. For example, lenders typically require 2 years tax returns to qualify for a loan. What if you haven’t filed your latest returns due to business complexities? What if your income dipped in the most recent year but has since fully recovered? These are examples of times when a borrower may not qualify for a traditional loan but could realistically afford one.

If you’d like to learn more about the types of programs that are now available and the parameters specific to your situation, CLICK HERE and I’ll send you a quick sample of some of the program highlights available.

Jeremy Beck

Mortgage Planner

Carefully Crafted Creativity